**** PUBLIC BANKING INSTITUTE: Essential Reading on What Wall Street Costs America

****************************************************************************

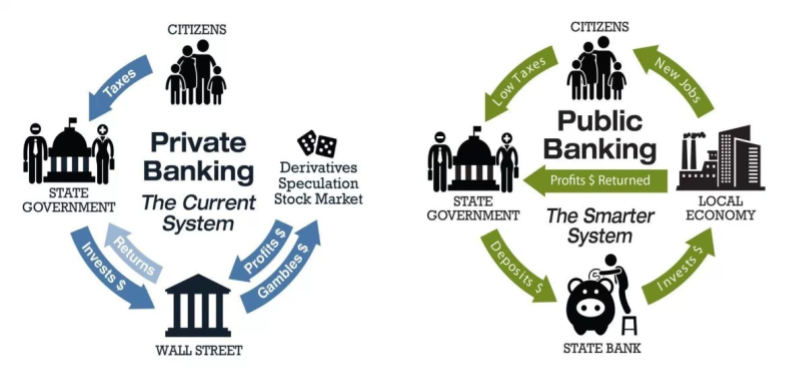

What is a Public Bank? ... Thanx to Ellen Brown

This posting will serve the "Too Big To Fail Ba(n)kery" and "Mo of Yo Money" series of this journal/ blog. It's in the "Mo of Yo Money" series, because all this is our money that is being played with, casino style ... our pensions/ retirement, investments, savings, taxes, etc ... draining the individual worker, to the small business owner, taxpayer, and squeezing our states and cities. It's in the "Too Big To Fail Ba(n)kery" series, because since the last financial crisis, these reckless institutions have become much larger. These institutions now, with support from this current administration and congress, have even pushed for more deregulation. I been following the "Public Banking" movement for several years ... well, actually since after the 08 financial crisis. Public Banking is nothing new, in fact, it was common in the U.S. years ago, and was key player in our economy/ business, infrastructure and industrialization, and other countries to this day ... even the USPS done banking at a time (1911 to 1967). So this is to look at some of the progress of this current public banking movement to date, and look at the growing awareness, and finding solutions to our banking dilemma. A short opening video above to explain why public banking is sensible, and a couple links below on how this idea has been spreading across the country, why, and the need for diversifying our public money more efficiently, and how we are getting railroaded and milked dry. Also a link to Ellen Brown's blog, Ellen been on this for years, and has covered this thoroughly. The Laura Flanders video below, will also explain what is happening, and those that are taking action to make change, New York City's problem ... and how to make that change. At the bottom of this posting, I will add some of my views. And much credit to these folks in New York City, as well as the California Public Banking Alliance, and especially how Portland (OR) put their foot down with these folks, and all who are divesting from these mega institutions. Because these folks have no incentive to change a thing, the only alternative is for the consumer/ public to put a foot in their ass, and limit them on the amount of our money they can play with.

***** THE PROGRESSIVE: A Movement for Public Banking Gains Momentum ... (newsread)

***** NONPROFIT QUARTERLY: Public Banking Movement Gains Ground in Cities and States across the US ... (newsread)

***** WEB OF DEBT BLOG/ ELLEN BROWN: The Public Bank Solution ...

A Public Bank for Public Good! ... Thanx to The Laura Flanders Show

*****************************************************************************

*****************************************************************************

***** PD/ RCJ: "TOO BIG TO FAIL BA(N)KERY" ... PART'S 5 THRU 1

***** PD/ RCJ: "MO of YO MONEY" ... PART'S 14 THRU 1

****************************************************************************

Thomas Hudson Pickering/ Ranch Chimp

I guess the popular talk would be ... "what banking dilemma?", after all, the big banks are doing great at record profits and growth, strong economy, etc. You'd be doing great too, if you had congress on the payroll, and in the pocket, and your lawyers drafted all the legislation ... giving you a free ride with unlimited access to every dollar of workers savings, all retirement accounts, mortgages, city/ state money ... with hardly any accountability required or oversight and input of where most is invested, and for what. Look at New York City, and what they shell out just to manage their funds. The majority of Americans can budget and spend better than they can, because the majority of Americans have to feel consequences, unlike freeloader Wall Street. Look at the high speed trading, short selling, stock buybacks, mergers, the volatility, where much money is invested abroad, conflicts abroad, and for what, your return, and the stock market roller coaster, etc. There is alot to look at today ... do we want all our eggs in one basket?, most under the control of a small handful of investment bankers? ... the same entities that played the same way when we had the 08 crisis? We do this out of desperation? or because were told we need to worry about China or whoever? ... and I actually agree with President Trump on the trade deficit with China, and glad someone pointed it out, but it's not China's fault, it's ours ... who made the trade deals, eh? I agree with him as well on the AT&T/ Time Warner merger ... I mean, the ink isnt even dry on that, and AT&T already has more acquisitions lined up. This mega merger also opened the flood gates for a long line of others waiting their turn to use this as precedent. How are things like that going to impact markets, jobs, customer satisfaction, products, services, prices? The mega banks and corporations is what's driving this desperation, to the point of insanity, putting us all in a squirrel cage financially and mentally, with unprecedented debt, as they all receive unprecedented wealth, eh? These are the same folks who pushed for the end of Glass- Steagall, and pushing for everything public to be turned over to their exclusive ownership ... a form of corporatized communism. Breaking away from this deadbeat thinking, is key to change, because they are not going to change a damn thing themselves, and listening to these assholes about how tough they have it, is pointless. It's our job to push for things like public banking, and looking out for our cities, states, families and selves, as a nation, that embrace our democracy and free choice.

***** INVESTOPEDIA: Should commercial and investment banks be legally separated?

We dont need these entities to manage our money any more than we need mega insurance giants to manage our damn broken health care system ... and we can save a bundle and substantial amount in debt increase by doing more ourselves. There is no better time than now, to tighten up our banking, and look at owning our own banking system ... which is also, the entrepreneurial capitalist spirit. Since everyone loves the term "free market" today, in our progammed pop culture economics on steroids ... that is what our target goal should be ... making our free market freer, and having choice. Too much of our hard earned money is being wasted on subsidizing and breast feeding these entities, with not enough being invested here in our own country on our needs. What does the new housing market look like coast to coast that is booming now? ... where is any of it affordable to working classes and moderate middle classes? ... we need affordable housing development, and that is a good market investment, because there is more demand ... we need to do it ourselves, in our towns ... since they are not. Most of what is loaned out here, is not even going to fair deals on infrastructure and utility needs, we are getting double and triple dipped on what we do get. These entities with their commercials and mega advertising costs, also subsidized, talking about their love for us and families, dont even give a shit about our health or well being. Back in April, Goldman Sachs said curing patients, illnesses, like Hepatitis C or whatever, is not a sustainable business model (CNBC) ... at least they're honest on their goals ... they want us sick, desperate, and in need of them, they dont want cures ... and they want to take higher risks with our money, and have more control over it too? ... you know, like "fuck them", eh? And our other sweetheart, Wells Fargo, are under a new investigation, again, for more underhanded shit, on folks retirement and investments (USA TODAY) ... I mean, the ink hasnt even dried on their last offense. We need more options when it comes to our money, and be more diversified on how we spend and save for our future well being, we already have our cell phones thinking for us, we dont need them thinking for us too. For me, I have no problem with what they do with "their" investments, play all you want, with who you want, gamble at your own risk, not ours ... after all, that is their own philosophy ... why should we give them more than we already have?, would they do the same for us?, of course not ... it's insanity.

Word Out ....

****************************************************************************

*****************************************************************************

***** RANCH CHIMP JOURNAL "WELCOME" POST

***** RCJ MUSIC/ ART'S HONOUR ROLL SOCIETY (my hand- selected music/ arts picks)

***** "THE RESISTANCE | PERILS OF THE POWER POSSE" ... ( a 2 part futuristic Ranch Chimp Journal dream to dream on )

****************************************************************************

6 comments:

Useful Information, your blog is sharing unique information....

Thanks for sharing!!!

aggregate farming software providers

best farm management software

Agtools: Thank You ... but the most importante thing, is that thousands of people in this country are asking questions, talking about these issues, and taking action to make incremental changes on various avenues.

I'll have to look into what options are available in this part of Oregon. We have a lot of local credit unions.

This sounds like the kind of thing the Trumplings -- or any Republican administration -- would try to sabotage, unfortunately.

Infidel: I was checking out the meetings on this in Portland, and there are many other cities looking at public banking and divestments too, especially from the private prison, fossil fuels and other investments, that have not the best results on our environment or social climate. Example of current, would be their big investments in immigrant detainment joints, of course with the excuse (sales pitch) is that they can do anything and everything cheaper than government, which they can do things cheaper, because they use all contracting and other cost cutting methods, again, to maximize profits ... but NOT efficiency, so we shouldnt be fooled at how cost cutting they can be ... there are also consequences to that (in other wods, when you do a cheap half assed job, you get cheap half assed results, eh?). Like the gentleman in Portland said ... (similar wording) ... public banking is part of "free market", it's all about choice (at least supposed to be, by these mega entities own claims, of course, due to their hypocrisy, everyone can see how full of shit they are ... when the public starts to ask for their freedom to choose). Of course republicans will be at the top of the list attacking such, considering it as being socialism ... you could give senior citizens and the sick and dying a 2% tax break, and these bastards would call that socialism too ... give these worthless hustling CEO's millions in tax subsidies, they call it free market, etc. The problem is, as pointed out in the links, as far as the rules and capital requirements of credit unions, and the restrictions vs. banks, which was all legislatively designed and drafted by mega corporate lawyers, obviously ... they and limit credit unions in other words, to increase investment banking profits ... which is ALSO anti- free market and choice ... so these bastards speak out of both sides of their mouth.Trump? ... you cant believe a goddamn thing he sayz, he's a hustler, this guy was actually using Bernie Sanders points and moves in some of his campaign, even using it on the republicans, but they are so delusional in thinking that he's the 2nd coming of the Christ figure, they wouldnt know a pitbull if it bit them in the ass. Even some mainstream democrats who been funded by investment bankers or related industries will block it too ... but you can halfway reason with democrats, Trump and republicans, are not likely to reason, it's their way or the highway. Thanx for your comment.

The 4 major banks (Four Horsemen of the Apocalypse) together with Goldman Sach's seized and sold 68 million mortgages as stocks! And having been bailed out with 29 trillion dollars, and having already sold the properties, they still foreclose on properties they do not even own!

How the scam worked: First, they converted 68 million US house mortgages into stocks, (the fancy word for this conversion of homes into stocks is called, “securitization”).

Next, Goldman Sach's sold off all these stocks and realized incomprehensible sums of money in commissions.

Pension holders and others bought them because the rating agencies said they were as safe as owning gold bullion (AAA rating - obviously they were bribed).

Turning 68 million mortgages into stocks was approved by the US Federal Government (Fanny Mae & Freddie Mac - obviously they were bribed).

Today, the big-four banking monopolies claim they hold the Note & Deed (Deed aka Mortgage or lien on the home). But in fact, they own nothing at all! These Wall Street Banking Terrorist have been illegally foreclosing on homes even though they have already been paid-off multiple times for these 68 million homes. Ironically, when the banks sold them as stocks they paid ZERO Tax! Under NY Trust Law and IRS Code 860, they were paid without having to pay any tax for the scam!

Result: 600 trillion in bad debt ; and the creation of innumerable worthless pensions made up of ‘unsecured’ home owners Notes. When the working man retires, his pension will likely be worth nothing. By this process, the Wall Street Banking terrorist have illegally stolen and resold 68 million homes while simultaneously destroying a large percentage of pensions from the working classes.

Consider also that the banks have scored even bigger by forcing insurmountable student loan debt onto the Young Americans – Debt for which they can’t bankrupt, take tax benefit, nor be bailed out! The Americans are now defacto slaves, or energy chattel, to the Rothschild Banking cabal! [And you thought men living in caves in Tora Bora were the terrorist! The terrorist are there on Wall Street all this time! By the way, it was Goldman Sach’s who was selling the Yellow Cake Uranium – not Iraq!] [2]

[2] [CBS removed the story] http://moneymorning.com/2014/02/17/goldman-sachs-dangerous-trade/

Sugarpuddin88: Thank you very much for your input and views here, and for the link as well ....

Post a Comment