Part 4 here of "Last Call to Rob Ya'll" is another of those "predatory lending" issue's, that is massive in this country, but it's just small loan's, not like the lending market's of real estate (**** this postings video and link updated in 2017). So many working Americans use these "Payday Loan" places, the Dallas- Fort Worth Metroplex probably has as many of these as the entire State of Missouri actually, but this drive/ campaign is going on in Missouri below in the first video, and listening to the gentleman in it who fell prey to this, Mr. Elliot Clark is sad, he is also a veteran, and my heart goes out to these folk's. I wouldnt even use these places when I got tight on cash, back about a decade ago I went through a period when I was between jobs/ lay- offs and unemployment checks coming in every two weeks ... until Pres. GW Bush denied us just "one" extension two week's before Christmas, which would have cost $5 billion ... then he turned around a month later in January and gave about $180 billion to Iraq or some shit : ) ... now that's a true unpatriotic low- life move (W) . Why wouldnt I use them? because when I looked into one of them, it was clear as day what the cost's were ... the only way you can avoid the high interest is to pay it back quickly basically, and that was still a tad steep ... I mean I was better off going to a pawn shop with jewelry, electronics, and guns, and get a lower borrow rate. Understand also when you borrow from them, they got a check from your account that you predate, meaning ... they have your "routing number" on the check as well ... they will get their's ... and maybe more, get my drift?

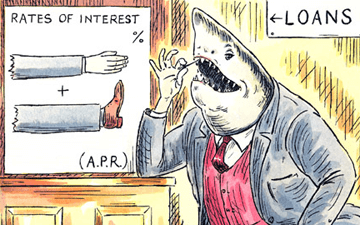

But isnt ALL lending predatory in a way? It's true that the working classes are most vulnerable to these practices, it's alwayz been like that, even with loan sharks, that's also capitalism. I am all for regulation's and fair business, etc, etc, as I write about constantly, that we need more oversight and accountability, consumer protection, etc on these mega institutions of finance ... but I also have my limits on that ... being I still want to give incentive for these businesses to be able to do well ... I am not into driving even corporations into bankruptcy ... the way a democracy and capitalism worx ... is that they do that to themselves. I personally dont need for the government to watch my back for every little thing that I do either ... I have to use my brain as well. This isnt like oversight and regulation over the housing market, or Bank of America or others that bring down the whole bloody country when they make ill moves, nor are they taking peoples investment portfolio's and gambling offshore with them, nor does it have to do with EPA/ environmental protections, FDA protection's, etc ... these are simply small loans that people take out in between paychecks ... you cant borrow unless you have a checking account and a paycheck and job, so it's not picking on the unemployed either. Understand that these lenders are banking on the fact that you will roll over the loan every two week's, the longer the better, because you pay more by keeping in debt to them and it, bottom line ... that's what their in business for, they are not a charity. If we/ government were to force them to make their interest rates so low to where they couldnt even make a reasonable profit, we would be more or less putting them out of business ... in a capitalism society, you dont have to worry, because if they get too greedy ... they will put themselves out of business, plain and simple ... unlike Wall St ... these folk's dont get bailouts, they get booted the good ole fashioned way ... by not staying competitive.

On the short term, these loans are a tad steep, but still in a fair range, maybe you could regulate the long term rates a little more, but still, the borrower has the option to pay it back in short or a longer term ... it's where the cost of the loan grows from keeping extending the same loan without paying it back, or at least when you redo the loan in two weeks, you could at least, retake out a smaller loan and pay at least half of it off that way, there are wayz to make it work is what I'm saying, but you have to also think when you act. The rates are clear in the places here in Texas, and they appeared to be as well in the store's there in Missouri ... I mean ... you dont even have to read all the fine print on the document/ contract you sign ... it's in bold letter's on the wall, with the percentage rate even, and basic math will figure it all out for you ... you dont even need a bloody calculator for that matter. But these businesses are booming like crazy in America in these times, because there is alot of folks demanding them and doing business with them simply. We have a little control ourselves that we dont alwayz see ... remember earlier several months back when Bank of America decided to put another fee on their customers what happened ... customers took their business to the competition, Bank of America changed their tune in a New York minute too and trashed that proposal and fee. You dont like their fee? ... dont do business with them, there are alternatives ... I sure as Hell wont do business with alot of folks, period. It's kind of like credit card's, but much smaller debts ... the credit card offers they keep mailing to you, I prefer debit cards instead these dayz over credit cards, after being there and doing that years back and getting into debt with credit card's ... I have a choice. However, when it comes to choosing to use even "debit" you must be careful , again ... shop for the smaller inde type institutions, I dont like using them if I can avoid them.

This is to me, more like us "loan barking" than them "loan sharking", but that's just the way I see this. The 2nd video below is a gentleman Mr. Mike Sullivan of "Take Charge America" who give's some tip's to keep in mind for solution's. Enough from me.

The vicious debt trap of payday lonas ... Thanx to KansasCityStarVideo

***** PBS NEWSHOUR: Fighting the debt trap of triple- digit interest rate payday loans ... (video/ transcript)

***** RCJ: "LAST CALL TO ROB YA'LL" PART'S 3, 2, & 1

Payday Loans- Take Charge America ... Thanx to TAKECHARGEAMERICA

*****************************************************************************

No comments:

Post a Comment